Brex Reviews & Product Details

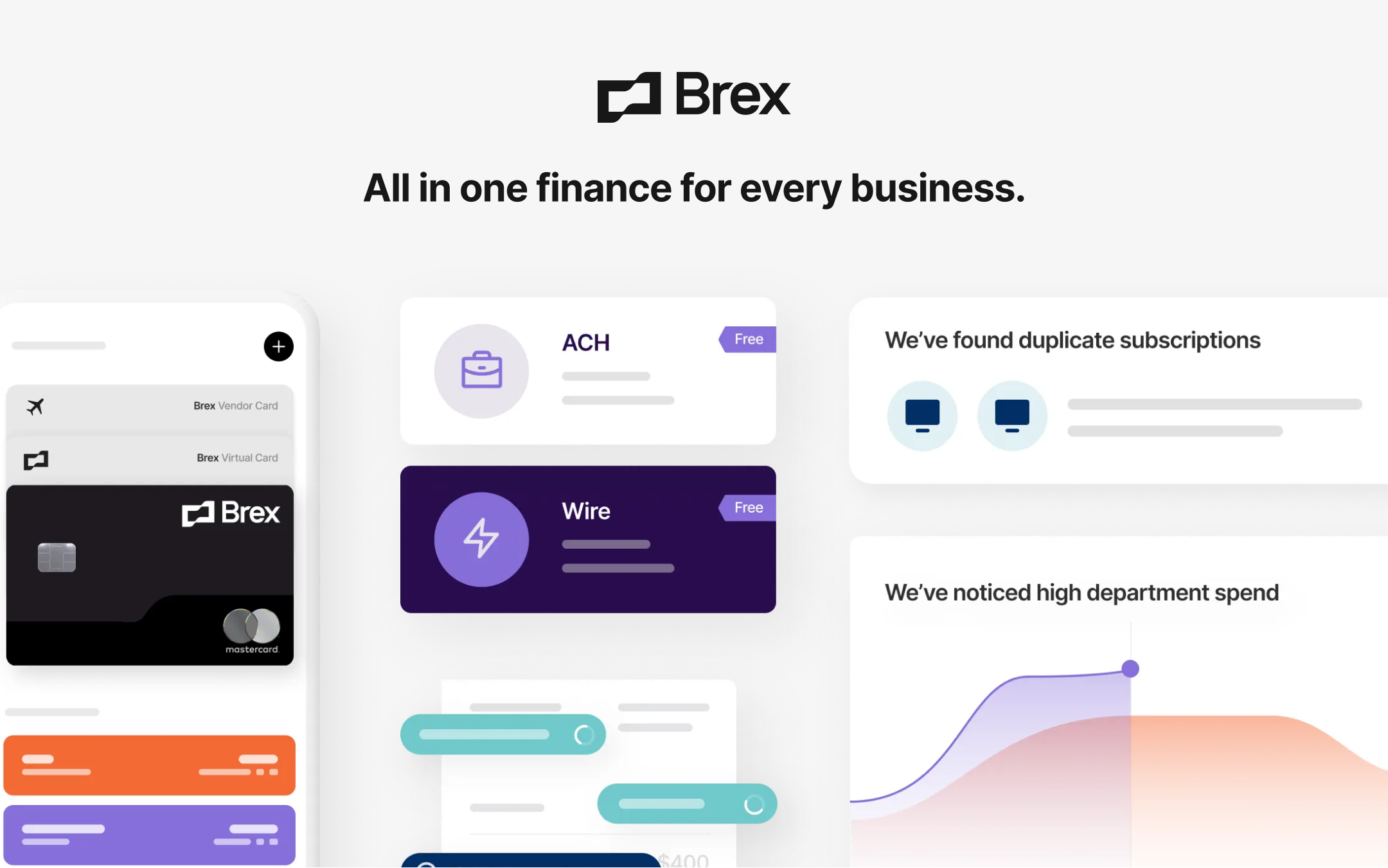

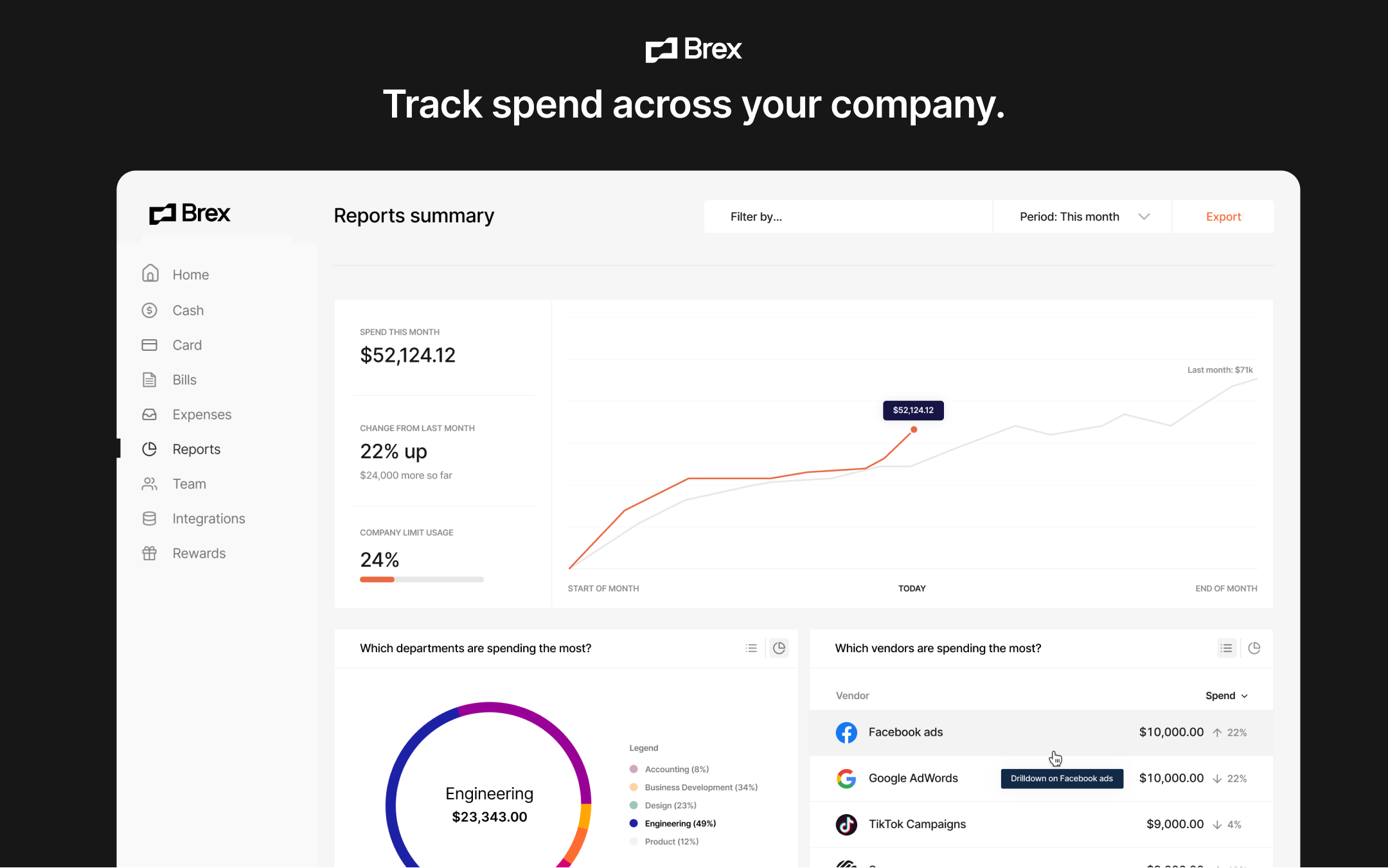

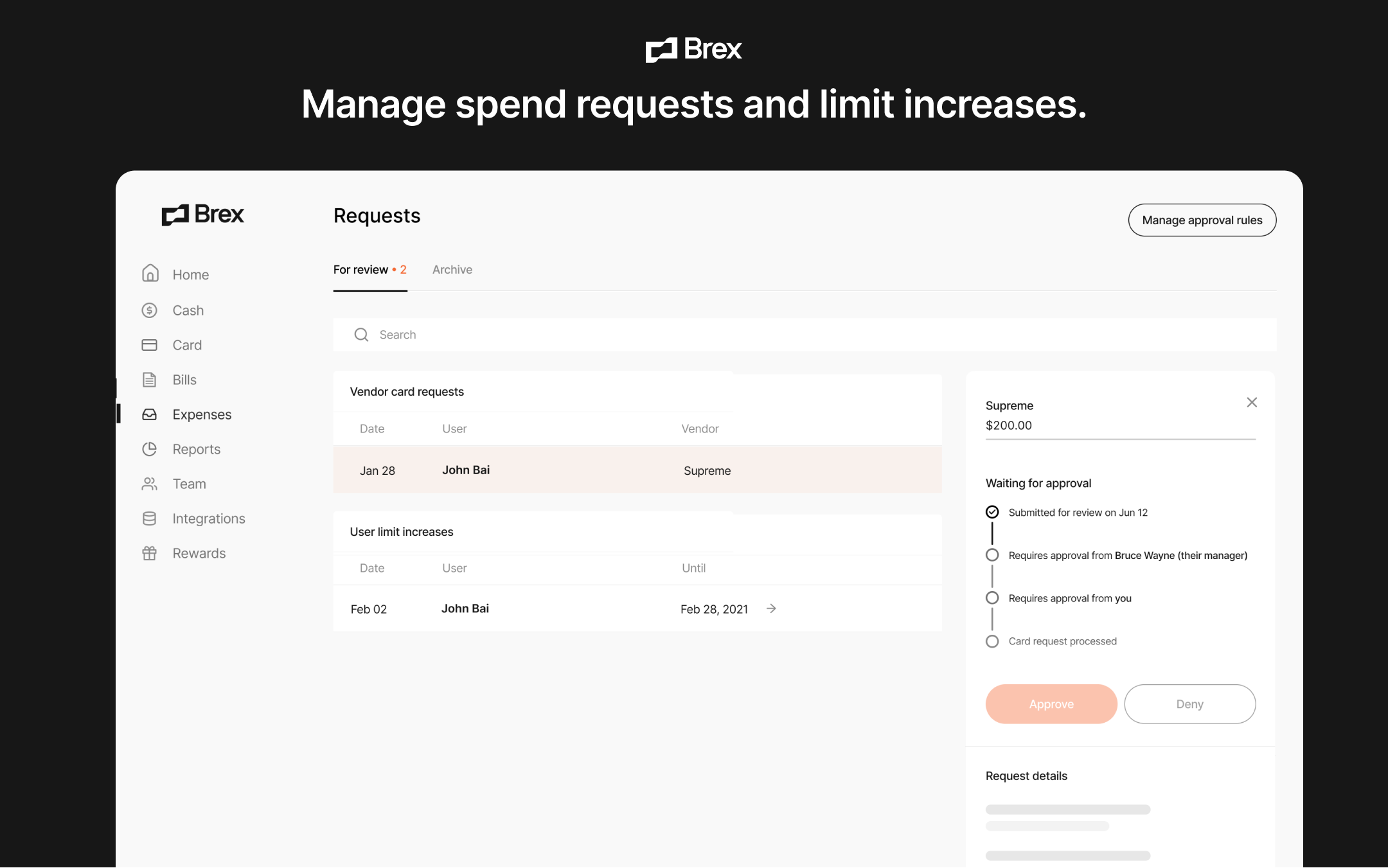

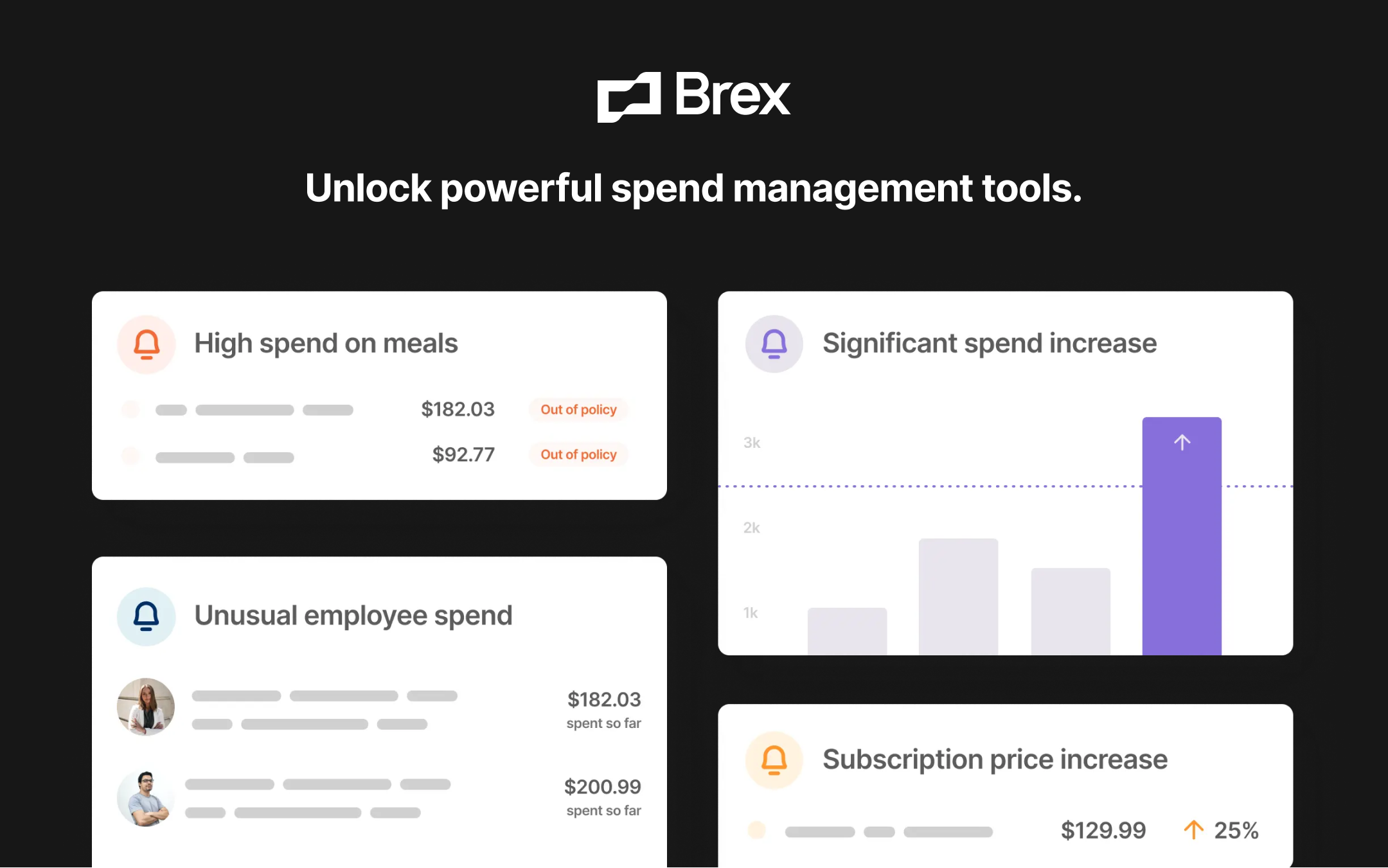

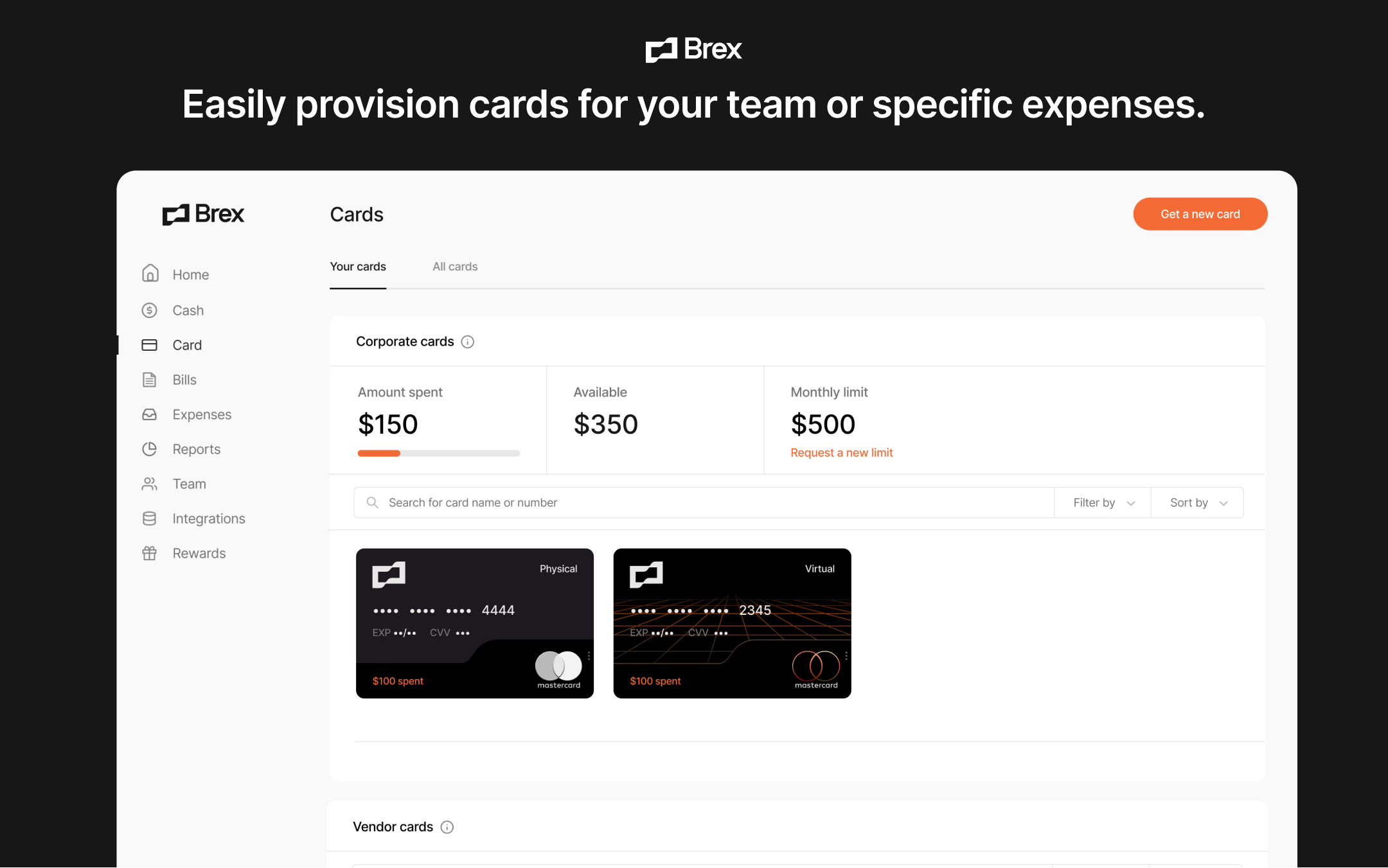

Brex is a financial services platform built especially for startups and small businesses. The software allows users access to expense management tools and even the use of corporate credit card and rewards programs so businesses can manage finances more efficiently and save money through rewards and discounts on business expenses.

| Capabilities |

|

|---|---|

| Segment |

|

| Deployment | Cloud / SaaS / Web-Based, Mobile Android, Mobile iPad, Mobile iPhone |

| Training | Documentation |

| Languages | English |

I liked te flexibility of the corporate cards.

They were too slow to update transactions.

To pay back my negative balance.

I like the app and being able to write memos in Slack to close out open expenses.

Having to sync to my checking account was not something that I liked. I also thought that expenses would be reimbursed in a few days, but they still seems to be on the paycheck schedule

I think Brex is taking a step forward than the last platform. The app and Slack integrations make it easier, but the receipt reader doesn't work, and having to click budgets and reasons can be confusing.

Attractive rewards, although the best ones are only for new accounts.

Signup process was partially broken, there is no information on the size of my credit line, no support line, QuickBooks integration is substandard, and their privacy policy says they can share my personal information with any of their partners.

None

receipts automatically included and credit card expenses automatically added

fraud block is hard to unblock; i wasn't able to unblock by calling bc i didn't have phone number set up; this caused a ton of problems during an offsite for the whole team

filing expenses

The fact that they were able to provide high card limits based on revenue with 60 days rolling payments. But since covid-19 their limits are way lower and unstable. they constantly change their limits and policies with no warnings and they don't offer the 60-day rolling product they used too.

The fact that they constantly change their limits and policies. You can have Brex as a backup but not as your main credit card. Unfortunately, covid-19 had a big effect on their policies no matter if your company was hit or not, they reduced limits. I am not saying don't use them but just consider other options like SVB. Also, don't count on them. use them as a backup credit card.

Cashflow

I used to be able to recommend Brex due to their generous rewards points, modern interface, and online support.

I'm not able to recommend Brex anymore due to their extremely shady business practices. For example, several months ago Brex devalued their cashback points with ZERO notice to customers. We only found out when redeeming points a couple months later. What used to be a 1-1 conversion was devalued to 1-0.6 conversion - with ZERO notice to users. We could've switched cards to maximize our points, or cashed out early, but clearly Brex has no interest in serving their customer's interests, only their own. Another example, Brex's corporate card is touted as having no foreign transaction fees. This is a lie. The truth is they mark up the conversion, such that the Foreign Exchange rate has a mark-up of 3%. This is the same as Chase and other banks, only that Chase has the decency to tell you. I'm not sure why it isn't illegal to omit this on their website or other info. There are other beefs - such as a recent change to their website UI that is entirely non-intuitive, and bank transfers taking up to two weeks to process - but these are the main ones. I cannot recommend Brex anymore. In short: 1. Devalue cashback points with zero warning or notification 2. FX markup of 3%, while touting no foreign transaction fees 3. Slow bank transfers, poor UI changes

Brex is one of our banking providers.

The only thing we liked was the PROMISES they made to be a credit solution for growing businesses. It turns out, Brex was unable to deliver on that promise anyway, so frankly... not a lot.

Brex informed us after about a year of using their card that there were closing all of the smaller accounts in the STRANGEST harsh and quickly written email I've ever seen. There were no options s for us whatsoever, just the email saying all small accts are closing.

None and it's not.

Liked the idea of a flexible credit line based on cash on hand.

Customer Service is lacking and is non-responsive

Flexible line of credit based on cash balance on hand.

The branding is cool, the points are great, the credit card just works, easy to get additional cards, the approval process is quick, the concierge is great during the signup process. Interest rate is competitive.

I have never used a buggier app. Their web app is barely functional. Dashboards routinely don't load. 2FA gets disabled and requires a new 2FA key (this is a HUGE security flaw). Overall I do not feel confident keeping $1m+ in this account.

They help with banking for startups. This means receiving VC investments, access to credit cards, managing different cards for different vendors and internal team members.

It was easy initially to setup. Useful when living overseas

They shutdown my account for being a low value transaction account

I run an eCommerce business and can realize cash back rewards on my card transactions. This works well for me because I pay my vendors by card always.

There's not much to like about Brex. Customer service is barely responsive. They don't offer the "white glove" service they claim. Not sure why anyone would bother using this not-a-bank bank account for your business.

We got short notice that they no longer wanted us as a customer. We've never had any issues - no overdrafts, no low balances, etc. A week after they sent notice they were closing our account, they decided to follow up with more detail: we had to be venture backed. Which we are. But any bank that would close business bank accounts on short notice isn't worth trusting.

None.

The platform is actually great. That's not the problem at all.

We got an email from Brex basically saying "we're closing your account in 2 months good luck." No other explanation. No recourse. We've barely started using Brex. We've spent the last 3-4 months building processes around it and are slowly transferring our payments, payroll, etc over to the account. We're literally in the middle of that process after having changed probably 100 recurring transactions, trained our team, written processes. There's no explanation of why they're closing our account. Their FAQ that the email refers to also offers no information but says there's no recourse. The decision is final. As of today their website still states "no minimum balance" and I don't see any indication of minimum turnover or anything. For all the downsides of a regular bank account, in my entire time dealing with regular banks I've never had one say "we're closing your account good luck" the decision is final. I've never even heard of that happening. It makes me seriously question letting an organization that is not regulated as a bank handle a large amount of our money if, on a whim they just close huge numbers of accounts without any explanation, recourse, ability to appeal, etc. You think they'll care about your money if they get into financial trouble?

None

I loved how they wasted our time. Thank you!

Closed our active business account without warning. We've been in business 15 years, we employee 30+ people, we have never had a negative payment, we always have cash in our account, we use it almost daily. No explanation just 'withdraw your funds and leave' We do website development for huge companies and have no strange activity that would contribute to this, and the decision is final. We have a few months to uproot everything and switch to a new account, update all our ACH info etc, connected accounts, etc.

They are not solving any of our problems and I wish they had never accepted our initial account **which would have been fine!** But if you get into a relationship with us and we meet our contractual obligations and you kick us off because we're not taking debt from you or whatever the reason was that we weren't profitable enough, GFY

Easy sign up and software works nice when you're small. BUT DO NOT USE THIS COMPANY. Brex is horribly managed and will cause catastrophic cashflow problems once your business gets big.

After 2+ years of running a large online business using Brex, they inexplicably closed our account (with zero notice) and froze our funds. Zero explaination, just an unhelpful automated email saying our account has been closed and the decision is final. Login disabled, funds frozen. The support team doesn't help and doesn't follow up when they say they will. This company is managed horribly on all fronts and does not care about their customers. As any business owner knows, getting your funds frozen and having all your customer payments suddenly bounce is catastrophic for an online business with daily expenses and daily revenues. Also, we had thousands of dollars in rewards points they decided to keep for themselves and not pay out. At any time, Brex's automated systems may do this to you and your business. We run a normal honest business, there is no justification for closing our account and breaking the cashflow lifeblood of our business with zero notice. DO NOT TRUST THIS COMPANY WITH YOUR MONEY. DO NOT RELY ON THEM. Brex will cause catastrophic problems for your business.

Brex is useless. See above. DO NOT TRUST THEM. This company will freeze your funds and steal your money. Brex is a horribly managed scam company with incompetent employees.

At first it was easy to sign up and all seemed good.

They dynamically change your credit limit without notice and withdraw funds from your account and then fail payments. The limit changes daily and they say it is the algorithm, but it has to be terribly flawed to have such massive fluctuations. The unauthorized withdrawals done without notice make it hard to manage cash flow, defeating the purpose of a NET 30 card. You can be fine one day, then your limit is cut by 80% and they reject your recurring payments and then raise it 25% 2 days later after you switched all your payments. Just very unreliable and customer service gives you a different story every time.

We had planned on using it instead of getting an AmEx to put all our monthly recurring payments on and then just make a single payment to Brex once a month. Needless to say it did not work out.